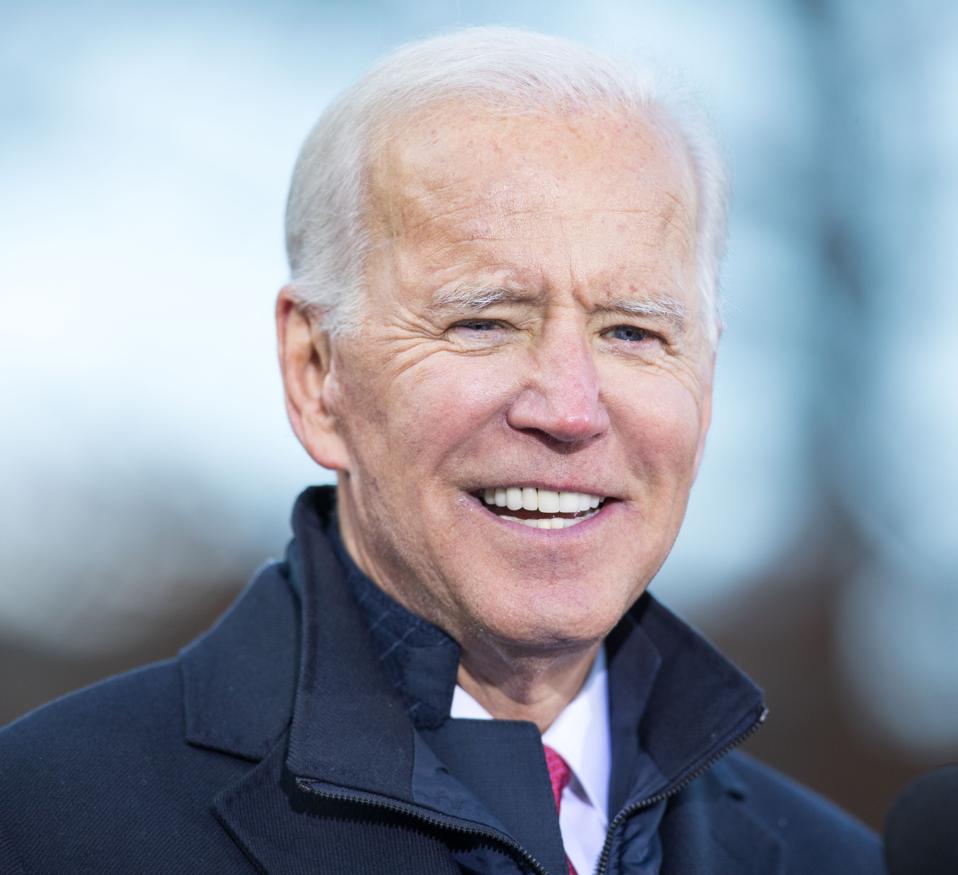

Biden: Cancel Student Loans 3 Ways

biden has referred to as on congress to cancel $10,000 of scholar loans for each borrower because of the covid-19 pandemic. for instance, congress could cancel pupil loans thru standalone law, or with the aid of inclusive of pupil mortgage cancellation in a new stimulus package. while house democrats blanketed scholar loan forgiveness within the heroes act — a stimulus package exceeded remaining yr — congress hasn’t exceeded any stimulus bundle that cancelled pupil loans. pupil loans have been dropped from the brand new stimulus package. biden additionally didn’t consist of scholar mortgage forgiveness in his modern-day $1.9 trillion stimulus bundle known as the yank rescue plan. it’s feasible that congress can also cancel scholar loans inside the new stimulus plan. congress nonetheless wishes to debate the provisions, so the contents of the stimulus package deal will be fluid. whether protected in standalone law or a stimulus package deal, the most probable quantity of student mortgage cancellation is $10,000 (many of the present day proposals) and student loan forgiveness could be one-time and in advance.

https://www.pcmag.com/picks/the-best-free-password-managers

one after the other, biden also wants to cancel your student loans inside the future. this future scholar mortgage cancellation is in addition to prematurely pupil mortgage cancellation. so, if congresses passes both proposals, you can qualify for upfront student mortgage cancellation and destiny student mortgage cancellation. how? biden wants to simplify earnings-driven reimbursement plans, which might be available for federal student mortgage reimbursement and commonly help debtors who are struggling financially. first, biden would make enrollment in income-pushed reimbursement plans automated (although you can decide out). 2d, month-to-month payment could be capped at five% of discretionary income (as compared with 10-20% underneath modern earnings pushed repayment plans). 0.33, scholar mortgage forgiveness could be automatic after two decades. fourth, not like current profits-pushed compensation plans, pupil loan forgiveness could be tax-free. this fourth alternate manner that if you get $30,000 of scholar mortgage cancellation after twenty years, you would not owe any profits tax in this student loan balance. biden will probable turn to congress to enforce these adjustments.

https://www.linkedin.com/company/google/life

biden also desires to forgive scholar loans for students who attend -year and four-year public colleges and universities. biden also might amplify scholar loan forgiveness to students who attend a non-public traditionally black schools and college (hbcu) or a minority-serving establishments (msi). there are numerous exceptions to this notion, but. first, pupil loan cancellation is simplest to be had for lessons-associated pupil loans, so this would exclude student loans for room and board, as an instance. 2nd, this notion best applies to university scholar loans, so graduate school student loans could be excluded. third, the notion doesn’t follow to student loans from personal colleges and universities. fourth, you need to earn $a hundred twenty five,000 or much less in line with 12 months to get pupil loan forgiveness. if congress passes this notion, which could correctly be a federal subsidy for states, this could reshape the future of better training. however, as congress prioritizes $2,000 stimulus tests, this could spell awful information for scholar loan forgiveness.

https://www.pinterest.com/umassmemorial/heart-health/

what’s the high-quality manner to repay scholar loans? there's no assure that any of those three proposals will become regulation. whilst democrats manage congress, many are looking forward to student loan relief. however, scholar mortgage cancellation currently isn't always included inside the new stimulus package, and it’s uncertain given other economic priorities if or whilst scholar loan cancellation becomes the focus. that’s why it’s vital to recognize your options for pupil loan repayment now. start with those three alternatives, all of which have no fees:

http://www.nytimes.com/sports/index.html?adxnnl=1&adxnnlx=1222012826-/l3zGTE6r9ghprB8q6xTqw

Comments

Post a Comment